City Council Approves 2025 - 2026 Tax Levy

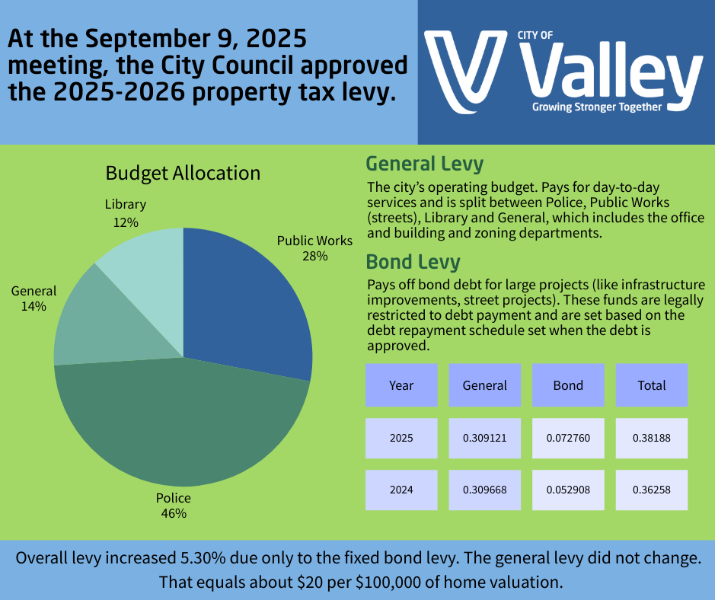

At the September 9, 2025 meeting the City Council approved the 2026 - 2026 tax levy.

The Overall levy increased 5.30% due only to the fixed bond levy. That equals about $20 per $100,000 of home valuation. The general levy did not change.

What is a Levy?

A levy is the city’s property tax rate. It’s the number the city sets each year to collect enough money to fund services and pay debts.

-

The levy rate is applied to your property value.

-

Example: If your property is valued at $100,000 and the levy is 0.30, you’d pay $300 in city property taxes.

General Levy vs. Bond Levy

General Levy:

-

This is the city’s “operating budget.”

-

It pays for day-to-day services allocated across city departments:

-

Police: 46%

-

Streets and Public Works: 28%

-

Library: 12%

-

General (office, building & zoning): 14%

-

-

Think of it like your household checking account that covers regular, ongoing expenses.

Bond Levy:

-

This is used only to pay back debt and is fixed based on the debt repayment schedule.

-

Current debt includes street pavement, water line extensions to the Pines, Ginger Cove and Ginger Woods, storm water drainage and sewer line infrastructure to Fremont, Nursing Home improvements and the SRF loan on current water improvement projects.

-

Money collected here can’t be used for general services as it’s legally restricted to debt repayment.

-

Think of it like the mortgage payment on your house which is separate from groceries and bills.

Launch the media gallery 1 player

Launch the media gallery 1 player